Prepaid Insurance Premium Journal Entry

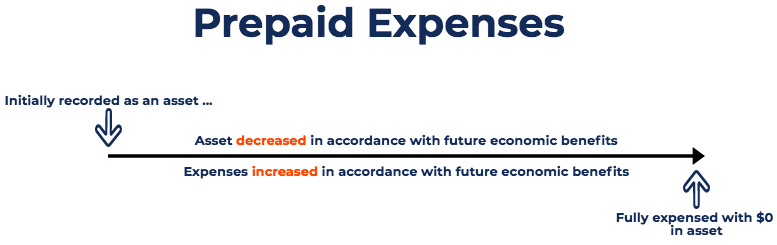

As prepaid insurance is an asset that will expire through the passage of time the cost of expiration will need to be recognized as an expense during the period. Prepaid Insurance Dr 10000 Bank Cr 10000 Every Month End Insurance Dr 834 Prepaid Insurance 834.

Prepaid Expenses Examples Accounting For A Prepaid Expense

Prepaid Expenses Examples Accounting For A Prepaid Expense

Lets look at some examples of prepaid expenses.

Prepaid insurance premium journal entry. Example 1 Say you buy a one-year insurance policy for your business that costs 1800. Is This Answer Correct. This is due to one asset increases 1200 and another asset decreases 1200.

If you are paying cash you are again increasing one asset account at the expense of the other because both cash and prepaid insurance are assets. What is the journal entry for insurance premium payment of a company. Is This Answer Correct.

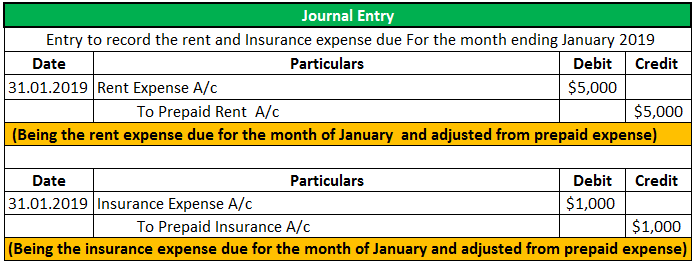

On December 31 2016 the expired portion of prepaid insurance 1800. When the asset is charged to expense the journal entry is to debit the insurance expense account and credit the prepaid insurance account. 4172014 After the payment you make the following journal entry at the end of each period.

Insurance Expense Journal Entry An insurance expense occurs after a small business signs up with an insurance provider to receive protection cover. Prepaid Insurance A XXX for unexpired policy You might check this out to find out more detailed explanation. It refers to the advance payment of insurance premiums to the insurance company for insurance coverage.

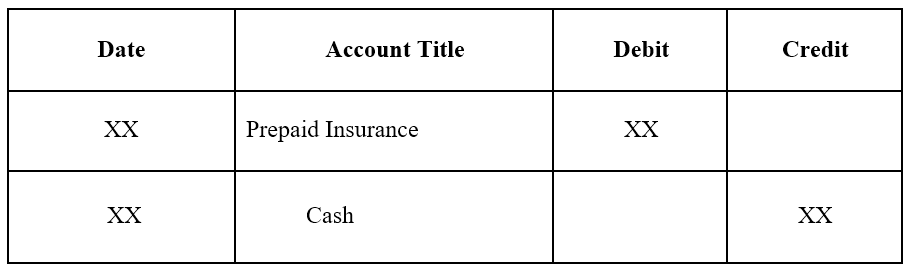

This is accomplished with a debit of 1000 to Insurance Expense and a credit of 1000 to Prepaid Insurance. Recording journal entries for insurance premiums are also similar. Journal Entry when Prepaid Insurance is paid Prepaid Insurance is debited which indicates the creation of an asset in the balance sheet.

Insurance Expense PL XXX Cr. 12172020 Prepaid Insurance Journal Entry Prepaid insurance is usually charged to expense on a straight-line basis over the term of the related insurance contract. Likewise the net effect of the prepaid insurance journal entry in this example is zero on the balance sheet.

2182020 Prepaid expense journal entries help you keep your accounting books accurate. On December 31 the company writes an adjusting entry to record the insurance expense that was used up expired and to reduce the amount that remains prepaid. 7162019 The prepaid expenses journal entry to post the insurance is as follows.

What is the journal entry for insurance paid by cheque. Example 2 Upon signing the one-year lease agreement for the warehouse the company also purchases insurance for the warehouse. The insurance expense account is reduced from 5400 to the expense for the year of 3600 and the amount of 1800 is transferred to the prepaid insurance account.

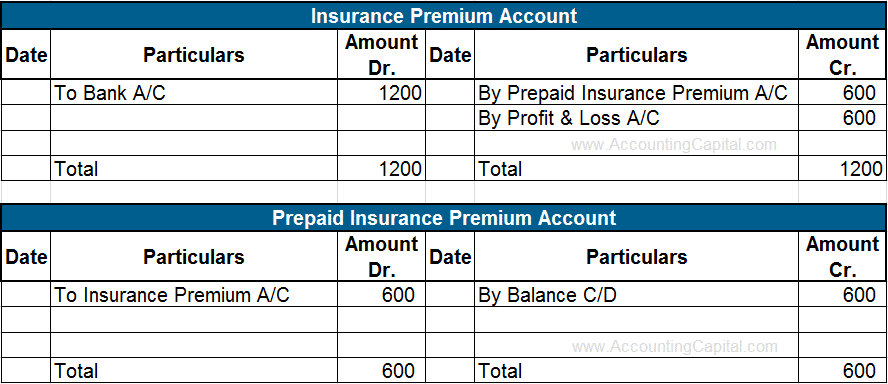

Example of Prepaid Insurance To illustrate prepaid insurance lets assume that on November 20 a company pays an insurance premium of 2400 for insurance protection during the six-month period of December 1 through May 31. Paid on 30th Jun YYYY 1200 for a year 50 prepaid for next year Premium prepaid 600 Accounting Cycle Ends 31 Dec YYYY Journal Entry on 30th June YYYY. 1062019 The adjusting journal entry is done each month and at the end of the year when the lease agreement has no future economic benefits the prepaid rent balance would be 0.

Prepaid exp ac dr to insurance. 5132016 I Blue Sky uses asset method to record the advance payment for its insurance premium it will record the whole amount of 1800 as an asset by making the following journal entry on October 1 2016. 312 450 will be converted into expense by making the following.

Since you are using cash your cash will fall and prepaid insurance will rise but total assets will stay the same. The company has paid 10000 of an insurance premium for the whole year at the beginning of quarter one. The insurance provider charges an annual fee called a premium which will cover the business for 12 months.

On November 20 the payment is entered with a debit of 2400 to Prepaid Insurance and a credit of 2400 to Cash. 12302020 journal entry for insurance premium paid in advance December 30 20200comments The key is to then immediately enter twelve journal entries one for each of twelve months in this case crediting Prepaid Expenses 1000 and debiting Insurance Expense 1000. The following journal entry will be passed and will be reflected in the books of accounts of XYZ company.

Example Journal Entry for Prepaid Insurance Company-A paid 10000 as insurance premium in the month of December the insurance premium belongs to the following calendar year hence it doesnt become due until January of the next year. The company has paid 10 000 of an insurance premium for the whole year at the beginning of quarter one. Prepaid insurance journal entries let s say xyz company who needs to pay its employee liability insurance for the whole of a fiscal year ending 31 december 2018 amounted 10 000.

Answer sumangal sarkar. 7252020 Prepaid Insurance is one type of prepaid expenses that we commonly see in the current assets section in the Balance Sheet.

Ch03 Financial Reporting And Accounting Standards

Ch03 Financial Reporting And Accounting Standards

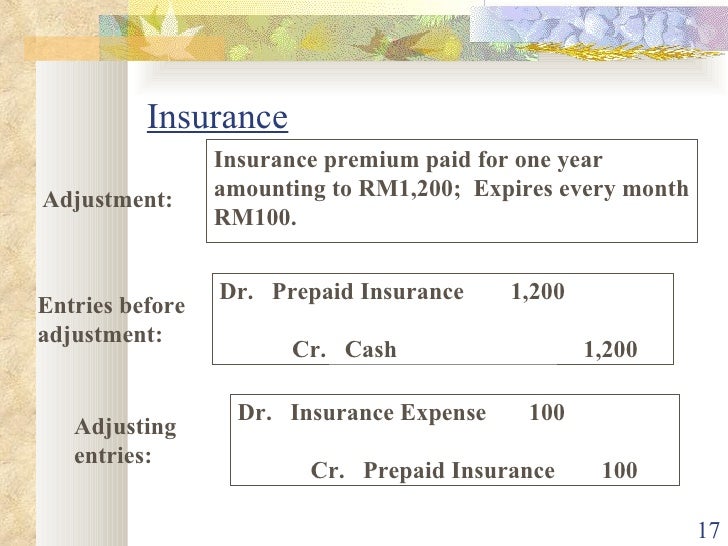

Adjusting The Accounts Accounting Principles Eighth Edition Ppt Video Online Download

Adjusting The Accounts Accounting Principles Eighth Edition Ppt Video Online Download

Insurance Journal Entry Example

Insurance Journal Entry Example

Prepaid Expenses Double Entry Bookkeeping

Prepaid Expenses Double Entry Bookkeeping

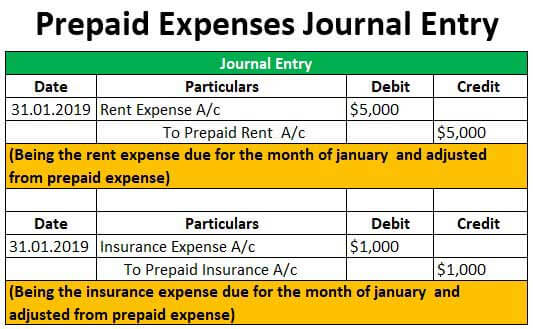

Prepaid Expenses Journal Entry How To Record Prepaids

Prepaid Expenses Journal Entry How To Record Prepaids

Prepaid Insurance Journal Entries For Prepaid Insurance Youtube

Prepaid Insurance Journal Entries For Prepaid Insurance Youtube

Prepaid Expenses Examples Accounting For A Prepaid Expense

Prepaid Expenses Examples Accounting For A Prepaid Expense

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

Chapter 3 Intermediate 15th Ed

Chapter 3 Intermediate 15th Ed

Prepaid Expense Examples Step By Step Guide

Prepaid Expense Examples Step By Step Guide

Treatment Of Prepaid Expenses In Final Accounts Accountingcapital

Treatment Of Prepaid Expenses In Final Accounts Accountingcapital

Insurance Premium Accounting Equation All Information About Quality Life

Insurance Premium Accounting Equation All Information About Quality Life

Posting Journal Entries To Ledger Account And Trial Balance Ppt Download

Posting Journal Entries To Ledger Account And Trial Balance Ppt Download

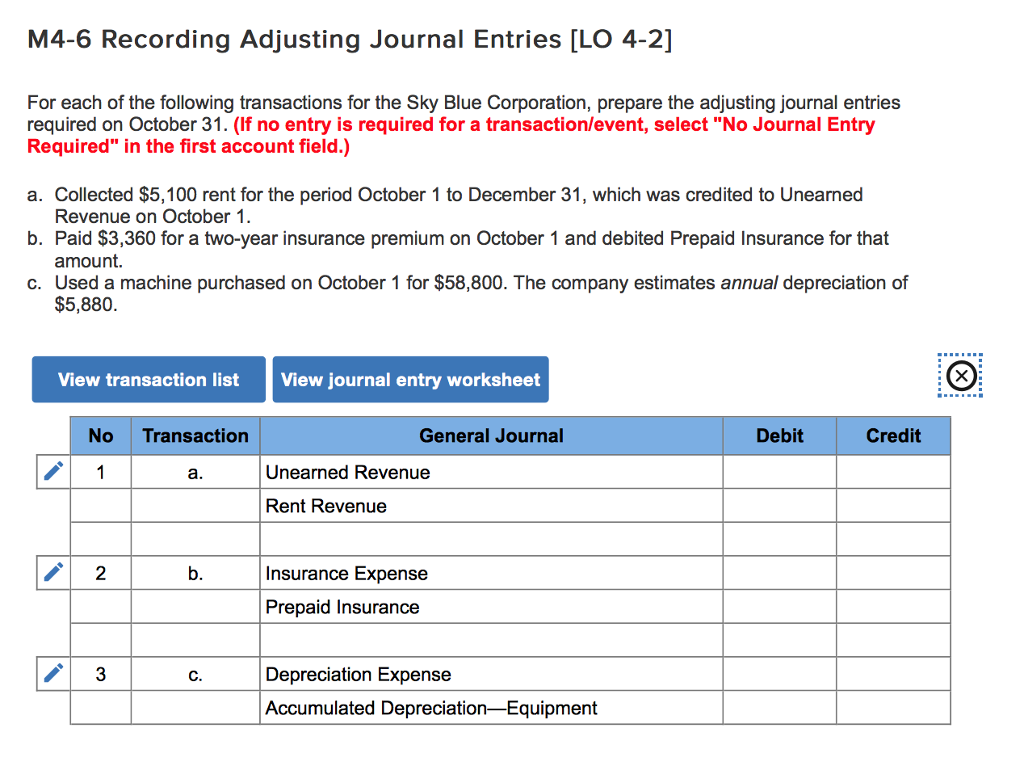

Solved M4 6 Recording Adjusting Journal Entries Lo 4 2 Chegg Com

Solved M4 6 Recording Adjusting Journal Entries Lo 4 2 Chegg Com

Prepaid Expenses Examples Accounting For A Prepaid Expense

Prepaid Expenses Examples Accounting For A Prepaid Expense

Insurance Premium Expired Adjusting Entry

Insurance Premium Expired Adjusting Entry

Post a Comment for "Prepaid Insurance Premium Journal Entry"