Aicpa Life Insurance K-1

Enhances your basic health coverage by providing up to 2 million in additional lifetime benefits. Schedule K-1 Final K-1 Amended K-1 OMB No.

Aicpa Cpa Life Insurance Aicpa Member Insurance Programs

Manage your account online.

Aicpa life insurance k-1. The AICPA offers several types of insurance plans that you can purchase if youre a member. Solutions to help protect your firm. 632020 In fact the refund ranges from 42 to 57 with the CPA Life increasing term depending on your age bracket.

Up to 25 million in term life coverage with an equal amount of accidental death and dismemberment benefits for individual members. Also a very simplified view of the policy holder outlives the tenure. Be sure to visit the most recent refund percentages for every CPA Life plan.

View your life disability and personal umbrella insurance policies. What does it mean to be an AICPA member. Exclusive offerings for AICPA Members only.

The Annual Cash Refunds vary year to year and while not guaranteed Firms under AICPA Group Insurance Trust have received Annual Cash Refunds from the Trust for over 50 years without fail. Request a quote now. Last 4 digits of your SSN.

The AICPA Trust Life Disability and Group Variable Universal Life GVUL Plans issued by The Prudential Insurance Company of America Prudential can offer insurance protection that helps provide security at affordable rates and the opportunity for Annual Cash Refunds. Assigned policies cannot be paid using CPA Easy Pay. AICPA Member Insurance Programs powered by Aon is exclusively endorsed by the AICPA to provide best-in-class risk solutions that help protect firms accounting professionals and their families.

The tax treatment of death benefits. Simply speaking Life Insurance helps protect the lifestyle of those you love should the unthinkable happen. Another key point to know is that spouse plans have a decreased refund percentage.

The K-1 statement specifies your portion of the taxable interest earned by the AICPA Insurance Trust or AICPA Group Insurance Trust How Your Life Insurance Rates Are Affected By The Trust Refund The Trust refund is no small amount with the CPA Life plans. They have several types of life insurance and long-term disability insurance policies. You also will receive a K-1 Statement.

Update your personal information. Heshe becomes an adult seeking coverage. Earnings by each Trust are redistributed back to the members of the applicable Trust as part of the Annual Refund.

The right AICPA Life Plan can help you have financial protection against the unexpected which is an important step toward securing a healthy. The AICPA puts a lot of effort into providing life insurance coverage to their members. That i was also building an investment company invests.

Just want to make a payment. Check the underwriting status of your pending applications. View and update your beneficiary for life insurance.

1545-0092 Form 1041NR Beneficiarys Share of Current Year Income Department of the Treasury Part III Deductions Credits and Other Items Internal Revenue Service For calendar year 2007 1 Final Year Deductions Interest Income 11 or tax year beginning _____ 2007 and ending _____ _____. Its money that can help cover expenses such as. It means youre connected to a professional network 400000 strong.

We are honored to partner with Aon to bring you innovative insurance solutions and risk guidance that safeguard your personal and professional interests. Once registered you can access My Account with your username and password to perform any of the following actions. With their long-term plan youll be able to get up to 12000 worth of.

Together we make the accounting profession possible. Annual Cash Refund distribution percentages are based on the Group Insurance Plan your Firm is enrolled in whether the Firm has elected dependents coverage and any Annual Cash Refund. The tax issues associated with key person term life insurance are relatively unambiguous.

264a1 provides No deduction shall be allowed for premiums on any life insurance policy. The money not used for claims expenses and other. Can I request an electronic copy of my K-1 from the Online Self Service Center.

According to the AICPA The K-1 statement specifies your portion of the taxable interest earned by the AICPA Insurance Trust or AICPA Group Insurance Trust AICPA Life Insurance Pros and Cons Conclusion. Solutions to Help Protect Your Firm. And it means youre challenged to seize that next career milestone.

It means you receive support and guidance for the work you do every day. View your Trust Annual Refund history and K-1. Funeral costs rent and mortgage college tuition for your children and retirement savings.

Insurance companies you are getting poor results. Our comprehensive suite of business insurance options is designed to protect your livelihood keep your employees safe and help the day-to-day operations of your business continue to run smoothly and productively so you can focus on your clients and grow your firm. If the taxpayer is directly or indirectly a beneficiary under the policy or contract.

Use CPA Easy Pay no log-in required for life disability and long-term care insurance. The K-1 statement specifies your portion of the taxable interest earned as part of the AICPA Insurance Trust or the AICPA Group Insurance Trust. Yes a reprint of the most recent K-1 is available for the latest Annual Refund distribution.

Just go to the Annual Refund page select the most recent year and click on Print K-1. Aicpa Life Insurance Trust K-1 - An aspect which is by signing certificates before a patient and persistent.

Aicpa Cpa Life Insurance Aicpa Member Insurance Programs

Aicpa Cpa Life Insurance Aicpa Member Insurance Programs

Aicpa Cpa Life Insurance Aicpa Member Insurance Programs

Understanding Aicpa Life Insurance Trust Refunds Know Your Risks

Understanding Aicpa Life Insurance Trust Refunds Know Your Risks

2018 Aicpa Conference Ey Compendium

2018 Aicpa Conference Ey Compendium

Americans Favor Workplace Benefits 4 To 1 Over Extra Salary Aicpa Survey

Americans Favor Workplace Benefits 4 To 1 Over Extra Salary Aicpa Survey

![]() Aicpa Member Insurance Programs

Aicpa Member Insurance Programs

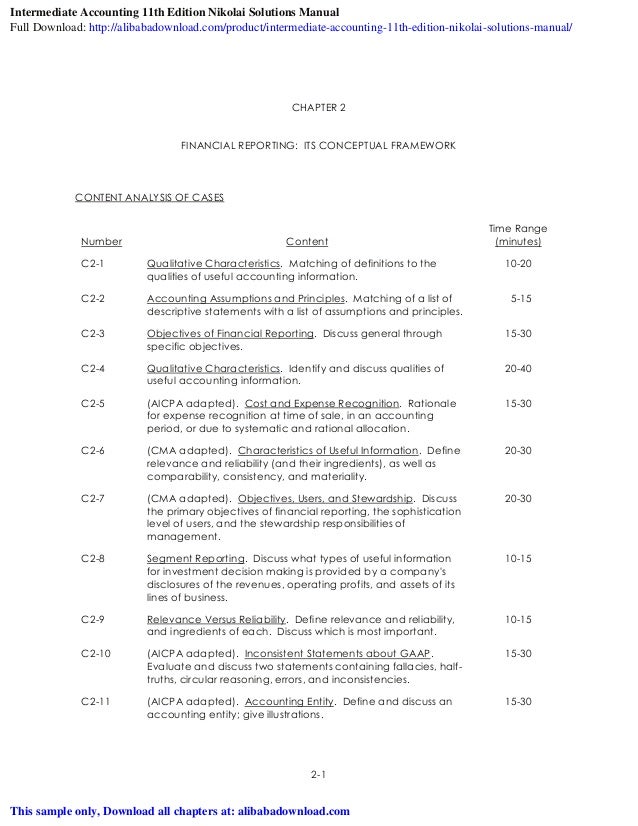

Intermediate Accounting 11th Edition Nikolai Solutions Manual

Intermediate Accounting 11th Edition Nikolai Solutions Manual

![]() Aicpa Member Insurance Programs

Aicpa Member Insurance Programs

Contoh Daftar Pustaka Makalah Dari Buku Dan Internet Buku Proposal Perpustakaan

Contoh Daftar Pustaka Makalah Dari Buku Dan Internet Buku Proposal Perpustakaan

![]() Aicpa Member Insurance Programs

Aicpa Member Insurance Programs

![]() Aicpa Member Insurance Programs

Aicpa Member Insurance Programs

Following Are Multiple Choice Questions Recently Released Becker

Following Are Multiple Choice Questions Recently Released Becker

How Do I Create A Budget Personal Finance Duke Budgeting Create A Budget Finance

How Do I Create A Budget Personal Finance Duke Budgeting Create A Budget Finance

Aicpa Cpa Life Insurance Aicpa Member Insurance Programs

Download Accounting Guide Pdf Free Mortgage Companies Life And Health Insurance Investing

Download Accounting Guide Pdf Free Mortgage Companies Life And Health Insurance Investing

Wk Cch Estate Planning Review Aicpa Pfp Section Thought Leadershi

Wk Cch Estate Planning Review Aicpa Pfp Section Thought Leadershi

Post a Comment for "Aicpa Life Insurance K-1"