Life Insurance On 1099-r

Payments of reportable death benefits in accordance with final regulations published under section 6050Y must be. Forms 1099-R and 1099-INT will be available on MyNYL or mailed to you by January 31 st each year.

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

If you own a life insurance policy the 1099-R could be the result of a taxable event such as a full surrender partial withdrawal loan or dividend transaction.

Life insurance on 1099-r. For non-qualified annuities a distribution is not reportable if only principal is withdrawn. The only tax adviser that they paid Miller suggested there would be a tax liability. Some how it appears that the entire amount of 32000 is being taxed in PA.

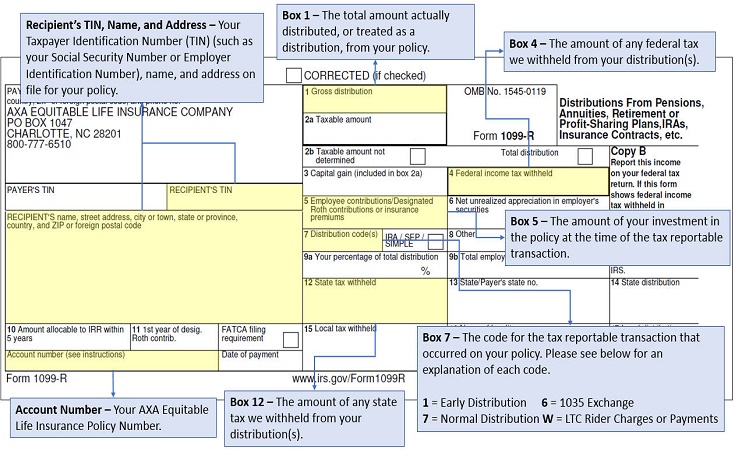

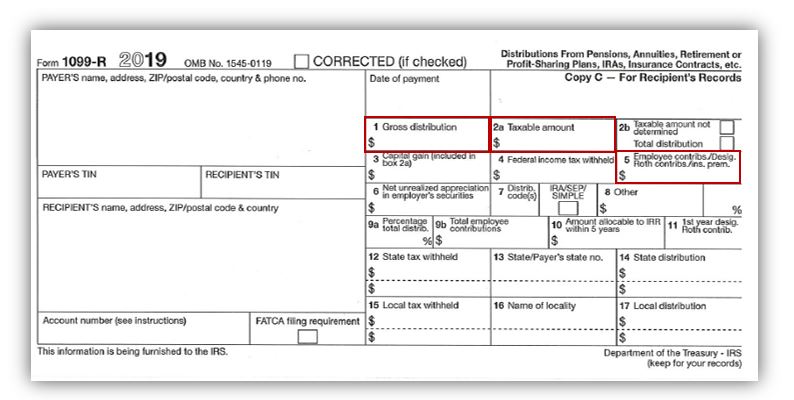

662019 Form 1099-R as life insurance distribution See this answer from one of our TurboTax agents in the following link as it does a good job in explaining this. The gross amount of the distribution taxable amount employee contributions tax withholding and the distribution code are reported to the contract owner and the IRS. Cost of current life insurance protection.

6222016 The Mallorys received the Form 1099-R from Monarch Life before the April 15 2012 filing deadline. May be eligible for 10-year tax option. 12142020 A Form 1099-R is issued.

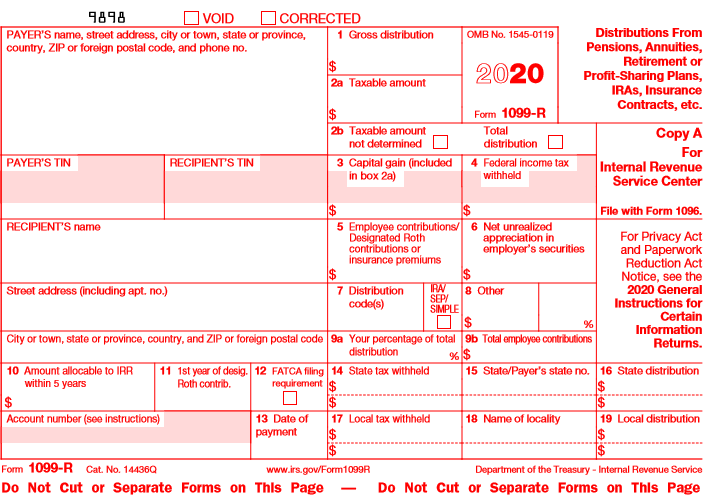

Reports taxable events. You will receive a 1099-R if you took a taxable distribution from your annuity in 2020. Life insurance contracts charitable gift annuities etc.

Annuities pensions insurance contracts survivor income benefit plans. Excess contributions plus earningsexcess deferrals andor earnings taxable in 2020. It appears as if TT is only taxing the pro.

Form 1099-R - Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc is a source document that is sent to each person that receives a distribution of 10 or more from any profit-sharing or retirement plans any individual retirement arrangements IRAs annuities pensions insurance contracts survivor income benefit plans. If you buy a new life insurance policy by making use of a 1035 exchange you should receive a 1099-R reporting the distribution amount and showing a 0 taxable amount. If a 1099-R tax document is available for your contract you can access it beginning January 18 2021.

This is not a death benefit from a life insurance policy but is an annuity that was purchased from an insurance company. Cost Basis 24000 and received in 32000. 532014 Life insurance proceeds are income-tax free and are therefore the insurance company does not send you a 1099 for the monies.

When is a 1099-R issued. When the monies are paid to the beneficiary of the policy they can use the funds in the manner they see best. Forms 1099-INT and 1099-R There are two types of 1099s 1099-INT and 1099-R.

Copies of these forms which report income generated by an insurance policy are not only provided to the taxpayer of the designated distribution reflected on the form but the Internal Revenue Service and the appropriate state city or local tax department. - Answered by a verified Tax Professional. Any individual retirement arrangements IRAs.

Form 1099-R is sent when distributions or other policy activity occurs that is reportable to the IRS. 382021 File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from. This is very similar to receiving a 1099-R when taking a cost basis withdrawal or loan from a life insurance policy.

Section 1035 exchange a tax-free exchange of life insurance annuity qualified long-term care insurance or endowment contracts. A 1099-R is an IRS tax form that reports distributions from annuities IRAs retirement plans profit-sharing plans pensions and insurance contracts. A life insurance policy loan is not taxable as income as long as it doesnt exceed the amount paid in premiums for the policy.

Form 1099-INT is sent when you earn or receive interest that is reportable to the IRS. If you own an annuity the 1099-R could be the result of a full surrender a partial withdrawal or the transfer of the contract to a new ownerIf an annuity is owned by a non-natural person. 3192019 I received a 1099-R from an insurance company for a whole life policy that lapsed for 100000 the net of earnings and the cost of insurance.

Such as a. Profit-sharing or retirement plans. 1162020 1099-R for 1035 Exchanges.

See Box 1 later. 332021 I did not receive a 1099-R form from American General Life Services Co LLC for 2020. This is one of the big attractions for people to buy life insurance policies.

When will I receive my 1099-R. For an 8000 profit. 12212020 Life insurance contracts that provide payments for total and permanent disability Charitable gift annuities This means that your retired grandparents who regularly make withdrawals from their IRAs or 401ks to fund their lifestyle in retirement should get a.

612019 Rcvd a 1099 R from a life insurance company for an Annuity purchased 42008 and cashed in 2017. Also report on Form 1099-R death benefit payments made by employers that are not made as part of a pension profit-sharing or retirement plan.

4 Reason To Take Health Insurance Early In Live Life Insurance Facts Life And Health Insurance Health Insurance Humor

4 Reason To Take Health Insurance Early In Live Life Insurance Facts Life And Health Insurance Health Insurance Humor

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

1099 R 2020 Public Documents 1099 Pro Wiki

1099 R 2020 Public Documents 1099 Pro Wiki

1099 R User Interface Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Iras Insurance Contracts Data Is Irs Forms Irs Tax Forms

1099 R User Interface Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Iras Insurance Contracts Data Is Irs Forms Irs Tax Forms

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Bookkeeping For Self Employed Spreadsheet

Bookkeeping For Self Employed Spreadsheet

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

Cheap Car Insurance Florida Tinadh Auto Insurance Quotes Compare Car Insurance Insurance Quotes

Cheap Car Insurance Florida Tinadh Auto Insurance Quotes Compare Car Insurance Insurance Quotes

How To Read Your 1099 R Colorado Pera

How To Read Your 1099 R Colorado Pera

Understanding Your 1099 R Form Kcpsrs

Understanding Your 1099 R Form Kcpsrs

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Understanding Your 2018 1099 R Kcpsrs

Understanding Your 2018 1099 R Kcpsrs

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

Post a Comment for "Life Insurance On 1099-r"